Thinking about the day you can step away from the daily grind and enjoy life on your own terms? It's a dream many of us hold dear, and for good reason. Figuring out when that special time might arrive can feel like a big puzzle, but it really doesn't have to be. There are actually some neat little tools out there that help make this whole idea much clearer, giving you a picture of your future financial freedom. One such helper, a very useful one, is the Networthify early retirement calculator, which, you know, helps you see the road ahead.

This handy online spot lets you put in all sorts of details about your money. It asks about any cash that comes into the accounts you oversee, like your regular earnings hitting your bank. So, if you've got, say, a hundred thousand dollars in paychecks landing in your checking account each year, you can simply key that in. This simple step starts to paint a picture of your current money flow, which is, honestly, a pretty good first move for anyone looking to get a grip on their financial future. It's about getting a clear view of your starting point, so you can, you know, plan where you're going.

The beauty of these sorts of financial helpers is that they take what seems like a big, complicated question – "When can I stop working?" – and break it down into smaller, more manageable pieces. They help you think about things like how much you're putting away and how much you're spending, which are, in a way, the two main parts of this whole financial independence equation. It's a bit like having a friendly guide show you the way through a maze, making sure you don't get lost in all the numbers and figures that, frankly, can sometimes feel a little overwhelming. You can, so to speak, really get a handle on your money situation.

Table of Contents

- What Exactly Does a Networthify Calculator Do for Your Retirement?

- How Do You Put Your Money Details into Networthify When Can I Retire?

- Figuring Out Your Spending Pace - Networthify When Can I Retire

- Are There Other Ways to Get a Handle on Your Money's Future?

- Understanding Those Bills That Keep Coming - Networthify When Can I Retire

- What's the Secret Behind the Networthify Numbers?

- Making Changes to Your Spending Plan - Networthify When Can I Retire

- Looking at Different Ways to Track Your Money - Networthify When Can I Retire

What Exactly Does a Networthify Calculator Do for Your Retirement?

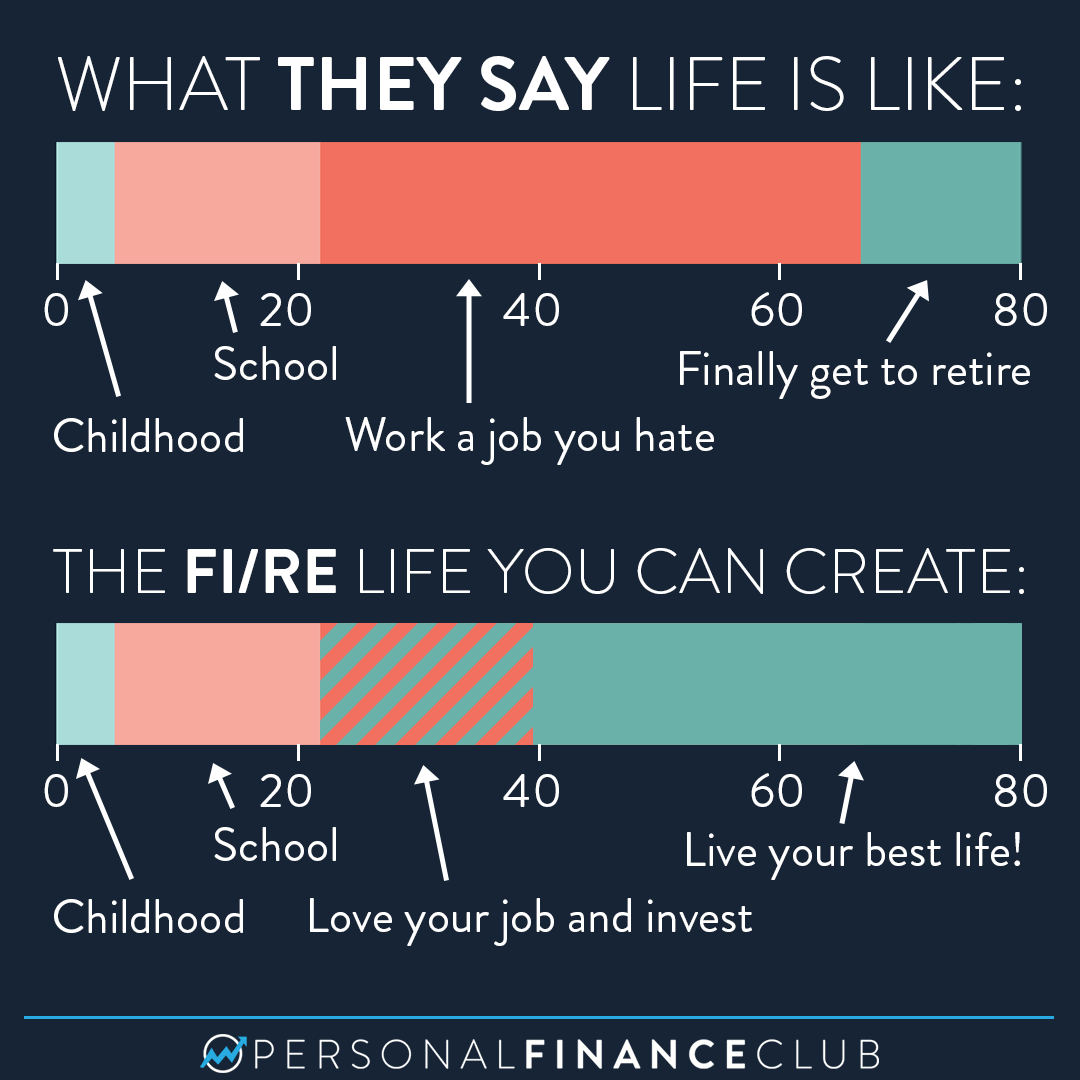

A tool like the Networthify calculator really aims to give you a straightforward answer to that big question: "When can I retire?" It does this by taking your current money habits and showing you what they mean for your future. It's not just about how much you have right now, but rather how quickly you're building up your financial nest egg and how much you're spending each year. Think of it this way: it helps you connect your daily money choices to that far-off goal of not having to work anymore. So, it's almost like a bridge between your present actions and your future freedom, which is, you know, pretty cool.

The core idea behind it is pretty simple, actually. It looks at your saving rate and your yearly spending. If you're putting away a good chunk of your earnings and keeping your costs low, you'll reach that point of financial independence much faster. It's a bit like filling a bucket; the faster you pour water in and the smaller the holes are, the sooner it gets full. This calculator just puts numbers to that simple idea, making it very clear to see the impact of your choices. It really helps you visualize, in a way, your progress.

People in the Money Mustache community, for instance, often talk about these kinds of calculations. They share their experiences and help each other figure out the best ways to use these tools. It's a shared effort to get a better grip on personal finances, and the Networthify calculator is often a topic of conversation there, particularly when discussing how to figure out a good spending pace for when you're not working. It's, you know, a common reference point for many folks.

How Do You Put Your Money Details into Networthify When Can I Retire?

When you sit down with a tool like Networthify, the first thing it asks for is your money coming in. This includes all the earnings that arrive in your bank spots or other financial accounts you manage. So, if you're getting paid a salary, that's what you'd put down. If you have other sources of cash, like rent from a property or maybe a side gig, you'd add those in too. It's about giving the calculator a full picture of all the funds you have access to, which is, in a way, your financial fuel. This initial step is, really, quite straightforward.

For example, if your paychecks add up to a hundred thousand dollars hitting your bank account over a year, that's the figure you'd enter. The calculator then uses this income number as a starting point for its figuring. It's not just about the big lump sum, but rather the steady flow of cash that supports your life. This input is, you know, pretty important because it sets the stage for all the other calculations that follow. You're basically telling the tool what kind of resources you have at your disposal, so to speak.

It's worth noting that this tool is designed to be pretty user-friendly. You don't need to be a math whiz to use it. You just need to have a general idea of your income and spending. The interface is usually pretty clear, guiding you through where to put each bit of information. It's about making the process of understanding your financial future as easy as possible, which is, honestly, a very helpful thing for most people. You can, for instance, just follow the prompts.

Figuring Out Your Spending Pace - Networthify When Can I Retire

Beyond just your income, the calculator also needs to know about your spending pace. This is, you know, how much cash goes out of your accounts each year. This is a big piece of the puzzle for Networthify when can I retire. It's not always easy to track every single penny, but getting a good estimate of your yearly bills is super important. This includes everything from your housing costs and food to transportation and fun activities. Every dollar you spend affects how long it takes to reach your financial goal. It's, arguably, the other side of the money coin.

The idea is that once you stop working, you'll need a certain amount of money each year to cover your life. The calculator aims to help you figure out how much money you need saved up to support that spending without having to work. This is where the concept of "25 times your expenses" often comes into play. It's a common rule of thumb in the financial independence community, suggesting you need to save about 25 times your yearly spending to be able to pull out about 4% each year without running out of money. This number, you know, is a widely accepted guideline.

So, if you spend forty thousand dollars a year, you'd aim for a million dollars saved. The Networthify tool helps you see how your current saving habits get you to that goal. It's a pretty powerful way to visualize your progress and understand the impact of your spending choices. It really makes the connection between your present and your future very clear, which is, honestly, quite motivating for many people. You can, in a way, see your progress unfold.

Are There Other Ways to Get a Handle on Your Money's Future?

While Networthify is a fantastic tool, it's not the only way to get a grip on your money's future. There are, for instance, quite a few digital sheets floating about that people have made themselves. Some folks, like me, have even put together their own number helpers within their personal finance spreadsheets. These can be very similar to the one talked about by MMM in the "shockingly simple math" write-up, which, you know, really laid out the basics for many people. It's about finding what works best for you to track your cash.

The Money Mustache community, which is a great place for learning and sharing, often has discussions about these different ways to track your money. You can ask a Mustachian for their suggestions, and you'll often get a bunch of ideas, from simple paper and pen methods to complex spreadsheet setups. The goal is always the same: to get a clear picture of your income, your outgoings, and how much you're putting away. It's, in some respects, about finding your own best method for keeping tabs on your funds.

Some people prefer the hands-on approach of building their own spreadsheet. This allows them to tailor it exactly to their specific needs and see all the formulas working behind the scenes. Others prefer the simplicity of an online calculator that does all the heavy lifting. Both approaches have their merits, and what's best really depends on your personal preference and how you like to interact with your money figures. It's, you know, about choosing a method that feels right for you.

Understanding Those Bills That Keep Coming - Networthify When Can I Retire

A big part of getting your money future sorted out, especially with a tool like Networthify when can I retire, is really getting a grip on your regular payments. These are the bills that just keep showing up, month after month, year after year. Things like rent or mortgage payments, utility bills, insurance, and subscriptions. These are the fixed costs that form the base of your spending. Knowing these figures accurately is, really, a key step in planning for a time when you won't have a regular paycheck coming in. It helps you, you know, prepare for what's ahead.

I recently put together another little tool myself, just to help me get a clearer picture of these kinds of costs. It really helps to see the whole price of things, not just the upfront amount, but all the expenses added up over time. This kind of deep look at your spending can sometimes reveal areas where you might be able to trim a bit, which, of course, means you can put more money towards your savings goal. It's about being very aware of where your cash is actually going, so to speak.

When you're planning for a time without work, these recurring costs become even more important. You need to be sure you can cover them comfortably from your savings. The Networthify calculator takes these into account when it figures out your needed nest egg. It's a bit like budgeting, but with a long-term view, making sure your future self has enough to live on without stress. This careful look at your regular bills is, honestly, a very smart thing to do.

What's the Secret Behind the Networthify Numbers?

Many people wonder about the exact method that tools like Networthify use to figure out those years to financial independence. They know there are several spots on the internet that handle this task, but it would be wonderful to have the math rule those websites use so that they can experiment with it themselves. It's a natural curiosity, wanting to peek behind the curtain and see how the numbers are actually crunched. So, it's almost like wanting to understand the recipe, not just taste the cake, you know?

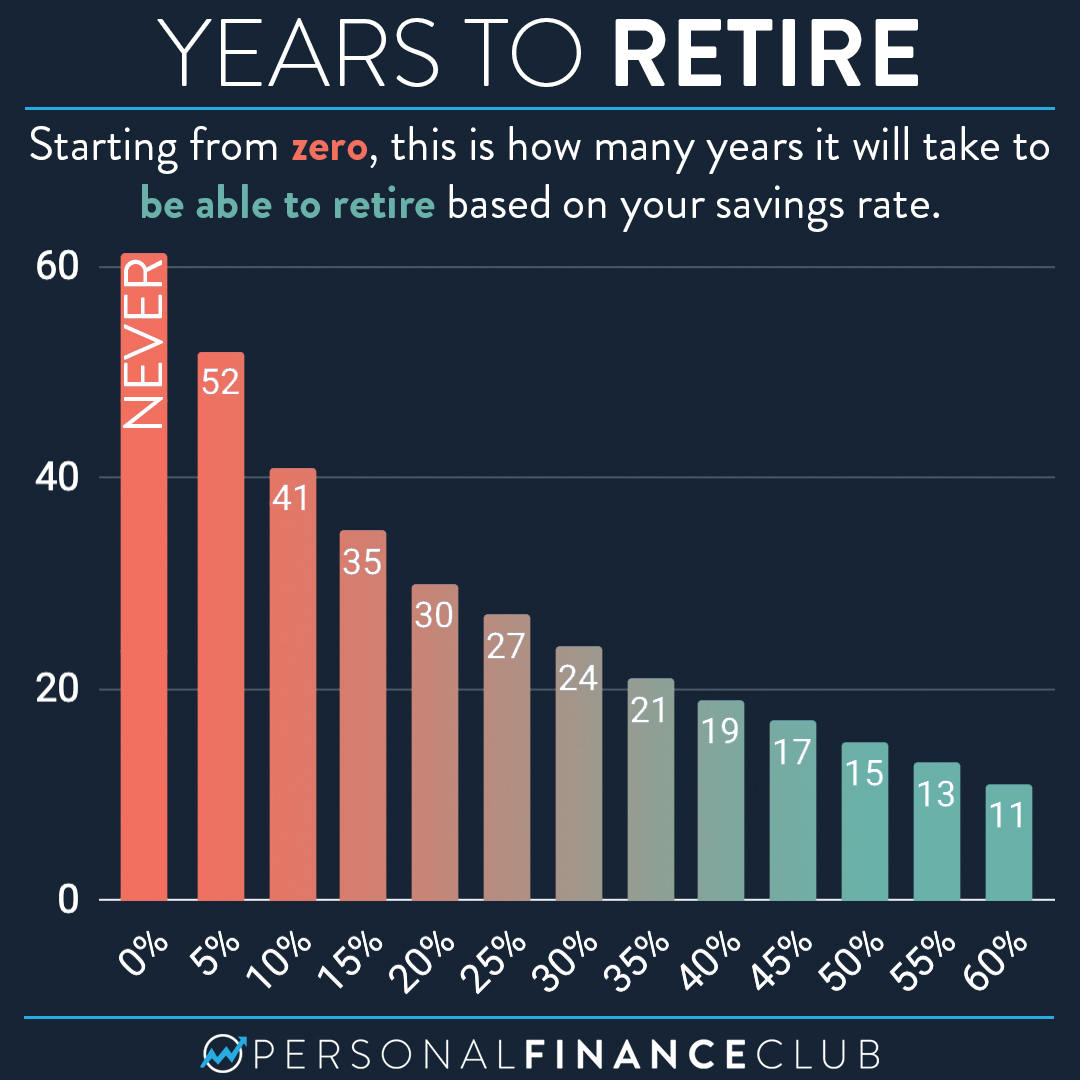

The core idea, as mentioned earlier, often revolves around the concept of saving a certain multiple of your yearly expenses. For instance, the general guideline often cited, and used by Networthify.com, suggests that if you put away half of what you make and your money grows by five percent each year, you'd require seventeen trips around the sun to pile up twenty-five times what you spend each year. This is, you know, a pretty powerful idea because it gives you a concrete goal to work towards. It's a way to put a timeframe on your dreams.

This "25 times expenses" rule is derived from the "4% rule" of withdrawal, which suggests you can safely take out 4% of your saved money each year without running out, assuming a certain investment return and inflation. The Networthify calculator essentially reverses this to tell you how much you need to save and how long it will take you to get there based on your income and spending. It's a mathematical shortcut to a very big life question, and it's, frankly, quite elegant in its simplicity. You can, for instance, really see the logic.

Making Changes to Your Spending Plan - Networthify When Can I Retire

One of the neat things about using a calculator like Networthify when can I retire is how easy it is to adjust your spending amounts. As far as changing your expenses for a time when you're not working, you just tweak the figures. This includes, you know, all your different categories of spending. Want to see what happens if you spend a little less on eating out? Just change that number. Curious about the impact of a smaller housing cost? Pop that new figure in. It's about playing around with the possibilities. You can, for instance, really experiment with your future.

This ability to "rijigger the numbers" is very powerful because it lets you see the direct impact of different choices. Maybe you realize that cutting down on one area of spending shaves years off your time to financial independence. Or perhaps you see that a small increase in your yearly budget doesn't push your retirement date back as much as you thought. It's a way to test out different scenarios without actually having to live them, which is, honestly, a very smart way to plan. You can, you know, see the consequences before they happen.

This kind of experimentation helps you make informed decisions about your current spending habits. It encourages you to think about what's truly important to you and where you might be able to make adjustments that align with your long-term goals. It's a very practical way to use a financial tool, making it a living, breathing part of your money planning, which is, really, quite engaging. It's, in a way, a personal financial simulator.

Looking at Different Ways to Track Your Money - Networthify When Can I Retire

Beyond the Networthify calculator, people often look at a bunch of other methods for tracking their money and figuring out their financial freedom date. There are, for instance, many different digital sheets floating around, made by individuals and communities, that aim to do a similar job. Some of these are quite simple, while others are rather complex, offering all sorts of charts and graphs. The variety means you can probably find something that fits your style of looking at numbers, which is, you know, pretty helpful. It's about finding your best fit.

The Money Mustache community, for example, is a rich source of information and shared tools. People often ask for recommendations on which ones folks can suggest, and the responses usually cover a wide range of options. From basic spreadsheets that simply track income and expenses to more sophisticated ones that project your savings growth over decades, there's a lot to explore. It helps you better understand the total cost of your life and how your saving rate impacts your timeline for Networthify when can I retire. You can, in a way, learn from others' experiences.

The goal is always to gain a clearer picture of your financial situation and how your choices affect your path to stopping work. Whether you use a pre-built online tool, a spreadsheet you found, or one you created yourself, the act of regularly reviewing your money helps keep you on track. It's about staying engaged with your financial goals and making sure you're always moving closer to that day when you can choose not to work. This consistent review is, honestly, a very important habit to build. It's, you know, about staying focused on your prize.

Author Details:

- Name : Ally Bartell

- Username : konopelski.kylee

- Email : garth.adams@swaniawski.com

- Birthdate : 1997-09-20

- Address : 888 Afton Station Suite 417 Port Denis, OK 60716-3086

- Phone : 478-887-4457

- Company : Kuhn, Huel and Rutherford

- Job : Telemarketer

- Bio : Consequatur aliquid dolore eligendi asperiores. Quia modi magni magnam ut quam. Autem laudantium illo eaque. Adipisci blanditiis est sunt nihil asperiores id.

Social Media

Tiktok:

- url : https://tiktok.com/@clueilwitz

- username : clueilwitz

- bio : Et aut temporibus rerum qui labore consequatur est.

- followers : 387

- following : 817

Linkedin:

- url : https://linkedin.com/in/coty3233

- username : coty3233

- bio : Rem tempora ut ut a.

- followers : 1424

- following : 1154

Instagram:

- url : https://instagram.com/coty.lueilwitz

- username : coty.lueilwitz

- bio : Quam rerum suscipit quidem nostrum quod occaecati. Rerum est sed tempore quas quia alias.

- followers : 978

- following : 344

Facebook:

- url : https://facebook.com/coty.lueilwitz

- username : coty.lueilwitz

- bio : Non explicabo eos qui nisi delectus.

- followers : 4156

- following : 147